CRM Software for Mortgage Brokers: Streamlining Your Business Operations

In today’s competitive mortgage industry, staying ahead of the game is crucial for success. As a mortgage broker, managing your client base, organizing leads, and streamlining your operations can be a challenging task. This is where CRM software comes to the rescue.

Why is CRM software important for mortgage brokers?

Managing relationships with clients and keeping track of important information is the foundation of a successful mortgage brokerage. CRM software provides a centralized platform that allows you to efficiently manage your client database, automate workflows, and streamline communication. By leveraging CRM software, you can enhance your efficiency, improve customer satisfaction, and ultimately boost your bottom line.

Benefits of using CRM software in the mortgage industry

-

Enhanced organization: With CRM software, you can easily categorize and segment your client base, ensuring that you have all the information you need at your fingertips. From contact details to loan history, you can access relevant data instantly, enabling you to provide personalized service and prompt responses.

-

Efficient lead management: CRM software enables you to capture, track, and prioritize leads effortlessly. By automating lead management processes, you can ensure that no opportunity slips through the cracks, increasing your chances of closing deals and generating revenue.

-

Automated workflows: Manual tasks can consume a significant amount of your time and energy. CRM software streamlines your workflows by automating repetitive tasks such as follow-ups, email campaigns, and document generation. This frees up valuable time, allowing you to focus on building relationships and growing your business.

-

Improved customer service: With CRM software, you can provide a seamless customer experience. Keep track of client interactions, notes, and preferences, enabling you to offer personalized service and tailored recommendations. Timely follow-ups and proactive communication create trust and loyalty among your clients.

Investing in CRM software is not just a choice; it’s a necessity for mortgage brokers looking to thrive in a competitive market. In the following sections, we will dive deeper into understanding CRM software, choosing the right one for your business, implementing it effectively, and maximizing its benefits. So, let’s explore the world of CRM software together and unlock the full potential of your mortgage brokerage business. Stay tuned!

Understanding CRM Software

Definition and Explanation of CRM Software

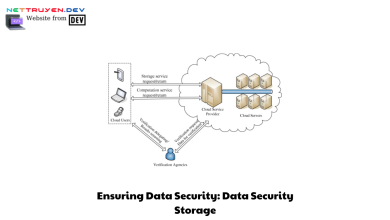

CRM software, or Customer Relationship Management software, is a powerful tool designed to help businesses effectively manage their interactions and relationships with customers. In the context of mortgage brokers, CRM software provides a comprehensive solution to streamline operations, improve customer service, and drive business growth.

At its core, CRM software acts as a centralized database that stores all relevant customer information, including contact details, communication history, and transaction records. This enables mortgage brokers to have a holistic view of their clients and facilitates efficient management of leads, prospects, and existing customers.

Key Features and Functionalities of CRM Software for Mortgage Brokers

-

Contact Management: CRM software allows you to create detailed profiles for each client, storing essential information such as names, addresses, and contact details. Additionally, you can track all interactions and communications with clients, ensuring that you have a complete history of every touchpoint.

-

Lead Tracking and Management: One of the primary functions of CRM software is lead management. It enables you to capture leads from various sources, such as your website, social media, and referral networks. With CRM software, you can assign leads to specific brokers, track their progress through the sales pipeline, and prioritize follow-ups based on their level of engagement.

-

Task and Activity Management: CRM software helps you stay organized by providing features that allow you to schedule and manage tasks, appointments, and reminders. This ensures that you never miss an important deadline or forget to follow up with a client, enhancing your productivity and efficiency.

-

Document Management: With CRM software, you can store and manage important documents, such as loan applications, contracts, and financial statements. Having all relevant documents in one centralized location not only saves time but also reduces the risk of misplaced or lost paperwork.

-

Reporting and Analytics: CRM software provides valuable insights into your business performance through built-in reporting and analytics features. You can generate reports on key metrics, such as conversion rates, revenue generated, and customer satisfaction. These insights empower you to make data-driven decisions and identify areas for improvement.

Understanding the capabilities and functionalities of CRM software is essential in choosing the right solution for your mortgage brokerage. In the next section, we will explore the factors you should consider when selecting CRM software and compare popular options available in the market. Let’s dive in!

Choosing the Right CRM Software for Mortgage Brokers

When it comes to selecting CRM software for your mortgage brokerage, it’s essential to consider several factors that align with your specific business needs. The right CRM software can enhance your productivity, improve customer relationships, and drive growth. Here are some key factors to keep in mind when making your decision:

Factors to consider when selecting CRM software

-

Customizability: Every mortgage brokerage operates differently, so it’s crucial to choose CRM software that can be customized to fit your unique processes and workflows. Look for a solution that allows you to tailor fields, create custom reports, and adapt to your specific business requirements.

-

Integration capabilities: Seamless integration with existing tools and systems is vital for maximizing efficiency. Ensure that the CRM software you choose can integrate with your lead generation platforms, email marketing tools, document management systems, and other essential software you use in your daily operations.

-

User-friendly interface: A user-friendly interface is essential to ensure smooth adoption and daily usage of the CRM software. Look for an intuitive and visually appealing interface that requires minimal training for your team to navigate and utilize its features effectively.

-

Mobile accessibility: In today’s fast-paced world, mobility is key. Opt for CRM software that offers mobile accessibility, allowing your team to access and update client information on the go. This ensures that you can provide timely responses and stay connected with your clients, even when you’re away from the office.

Comparison of popular CRM software options for mortgage brokers

To help you kickstart your search, here’s a comparison of some popular CRM software options for mortgage brokers:

-

Salesforce: Known for its robust features and extensive customization options, Salesforce offers a comprehensive CRM solution suitable for mortgage brokers of all sizes. It provides advanced automation, analytics, and integrations with various third-party applications.

-

HubSpot CRM: HubSpot CRM is a user-friendly and scalable solution that offers a range of features designed to streamline your sales and marketing efforts. It enables lead tracking, email automation, and personalized communication, helping you nurture client relationships effectively.

-

Zoho CRM: Zoho CRM is a budget-friendly option that doesn’t compromise on functionality. It offers lead management, analytics, and automation capabilities, along with integration options for popular mortgage-specific tools like mortgage calculators and loan origination systems.

Remember, selecting the right CRM software for your mortgage brokerage is a crucial decision that will impact your business operations. Take the time to evaluate your needs, compare features, and consider customer reviews before making your final choice. Stay tuned for the next section, where we will guide you through the implementation process, ensuring a smooth transition to your new CRM software.

Implementing CRM Software in Mortgage Brokerage

So, you’ve decided to take the leap and integrate CRM software into your mortgage brokerage. Congratulations! Now, it’s time to ensure a smooth and successful implementation. Here’s a step-by-step guide to help you navigate through the process and make the most out of your CRM software investment.

Step 1: Assess Your Needs and Set Goals

Before diving into implementation, it’s essential to evaluate your specific requirements and define clear goals for using CRM software. What are the pain points you want to address? What outcomes are you looking to achieve? By outlining your objectives, you can tailor the implementation process to your unique business needs.

Step 2: Choose the Right CRM Software

Selecting the right CRM software is crucial for a successful implementation. Consider factors such as ease of use, scalability, integration capabilities, and cost. Research different CRM solutions and take advantage of free trials to test their functionalities. Opt for a CRM software that aligns with your business goals and offers robust features tailored to the mortgage industry.

Step 3: Plan and Prepare for Data Migration

Smooth data migration is vital to ensure a seamless transition to the new CRM software. Identify the data you want to transfer from your existing systems and clean it up by removing duplicates or outdated information. Create a backup of your data to prevent any loss during the migration process. Develop a plan to map and import your data into the CRM software accurately.

Step 4: Customize and Configure the CRM Software

Make the CRM software work for you by customizing it to suit your business processes. Set up custom fields, workflows, and automation rules that align with your brokerage’s operations. Configure the software to match your branding and create a user-friendly interface for your team members.

Step 5: Train and Educate Your Team

Effective user adoption is crucial for the success of CRM implementation. Provide comprehensive training to your team members on how to use the CRM software effectively. Highlight the benefits and demonstrate how it can streamline their workflows and enhance productivity. Encourage their feedback and address any concerns or questions they may have.

Step 6: Monitor, Evaluate, and Fine-tune

Once the CRM software is up and running, continuously monitor its performance and evaluate its impact on your brokerage. Keep an eye on key metrics such as lead conversion rates, customer satisfaction levels, and overall efficiency. Identify areas for improvement and make necessary adjustments to maximize the software’s benefits.

By following these implementation steps and incorporating best practices, you can ensure a successful integration of CRM software into your mortgage brokerage. Stay tuned for the next section, where we’ll delve into the strategies to leverage CRM software for better customer relationship management.

Maximizing the Benefits of CRM Software for Mortgage Brokers

How CRM software improves efficiency and productivity in mortgage brokerage

In the fast-paced world of mortgage brokerage, time is of the essence. CRM software plays a vital role in enhancing efficiency and productivity by streamlining various aspects of your business operations. Here’s how it can help:

-

Centralized data management: With CRM software, all your client information, loan details, and communication history are consolidated in one place. This centralized database allows you to access and update information in real-time, eliminating the need for manual data entry across multiple systems. As a result, you can save valuable time and minimize the risk of errors.

-

Automated task management: Manual task management can be time-consuming and prone to errors. CRM software automates repetitive tasks, such as sending follow-up emails, scheduling appointments, and generating reports. By automating these processes, you can focus on more high-value activities, such as nurturing client relationships and closing deals.

-

Streamlined communication: Effective communication is the cornerstone of successful mortgage brokerage. CRM software enables you to streamline communication with clients through various channels, including email, SMS, and even integrations with popular messaging apps. Automated reminders and notifications ensure that you never miss an important interaction, allowing you to provide exceptional customer service.

Strategies to leverage CRM software for better customer relationship management

-

Personalization: Utilize the data gathered in your CRM software to personalize your interactions with clients. This could include referencing specific details about their loan preferences, addressing them by name, or sending targeted marketing campaigns based on their needs. Personalization builds trust and strengthens your relationships with clients.

-

Proactive follow-ups: CRM software enables you to set reminders and automate follow-up communications. Take advantage of this feature to stay in touch with clients throughout their mortgage journey. Sending timely updates, educational resources, and check-ins demonstrates your commitment to their success and helps you stay top-of-mind.

-

Analytics and reporting: Leverage the reporting capabilities of your CRM software to gain insights into your business performance. Track key metrics like conversion rates, lead sources, and communication effectiveness. By analyzing this data, you can identify areas for improvement, optimize your strategies, and make data-driven decisions.

By harnessing the power of CRM software and implementing these strategies, you can maximize the benefits it offers for your mortgage brokerage business. Enhanced efficiency, improved customer relationship management, and streamlined operations will set you apart from the competition and drive your business towards success.

Conclusion

In the fast-paced world of mortgage brokerage, leveraging technology to streamline operations and enhance customer relationships is crucial. crm software for mortgage brokers offers a powerful solution to manage clients, automate workflows, and boost productivity. By implementing the right CRM software, mortgage brokers can gain a competitive edge and achieve long-term success.

In this article, we explored the importance of CRM software for mortgage brokers and the numerous benefits it brings to the industry. From enhanced organization and efficient lead management to automated workflows and improved customer service, CRM software revolutionizes the way mortgage brokers operate.

As the mortgage industry continues to evolve, embracing CRM software becomes imperative to stay ahead of the game. The right CRM software not only helps manage existing client relationships but also drives new business opportunities through effective lead management and nurturing.

At nettruyen.dev, we understand the unique needs of mortgage brokers and the value CRM software brings to their business. Our team of experts can guide you in choosing the right CRM software that aligns with your specific requirements and goals.

Ready to take your mortgage brokerage to the next level? Embrace CRM software today and experience the transformative power it offers. Contact us at nettruyen.dev to explore how CRM software can revolutionize your business and propel you towards success.

Remember, in the competitive landscape of the mortgage industry, staying organized, efficient, and customer-centric is the key to thrive. Let CRM software be your secret weapon in achieving these goals and elevating your mortgage brokerage to new heights.

Conclusion: So above is the CRM Software for Mortgage Brokers: Streamlining Your Business Operations article. Hopefully with this article you can help you in life, always follow and read our good articles on the website: nettruyen.dev